You are here:Aicha Vitalis > trade

Bitcoin Price Como Funciona: Understanding the Dynamics of Cryptocurrency Valuation

Aicha Vitalis2024-09-21 01:54:13【trade】6people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the first and most well-known cryptocurrency, has captured the attention of investors, enth airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the first and most well-known cryptocurrency, has captured the attention of investors, enth

Bitcoin, the first and most well-known cryptocurrency, has captured the attention of investors, enthusiasts, and critics alike. Its price has experienced dramatic fluctuations since its inception in 2009, making it a highly sought-after asset. But how does the Bitcoin price work? In this article, we will delve into the mechanisms behind the Bitcoin price como funciona.

Bitcoin Price Como Funciona: The Basics

The Bitcoin price como funciona is based on the principles of supply and demand, similar to traditional financial markets. However, there are some unique aspects that differentiate it from conventional currencies. Here are the key factors that influence the Bitcoin price:

1. Supply and Demand: The supply of Bitcoin is predetermined and capped at 21 million coins. This scarcity, combined with the increasing demand for the cryptocurrency, contributes to its price volatility. When demand exceeds supply, the price tends to rise, and vice versa.

2. Market Sentiment: The psychological factors that drive investors' decisions also play a significant role in the Bitcoin price como funciona. Factors such as media coverage, regulatory news, and technological advancements can sway market sentiment and, subsequently, the price.

3. Volatility: Bitcoin is known for its high volatility, which means its price can fluctuate rapidly. This volatility is a result of various factors, including the limited supply, speculative trading, and regulatory uncertainties.

4. Trading Platforms: The Bitcoin price como funciona is influenced by the trading platforms where it is bought and sold. These platforms, such as exchanges and brokers, can have varying liquidity and fees, which can affect the price.

5. Market Makers: Large institutional investors and whales, who hold significant amounts of Bitcoin, can influence the price through their buying and selling activities. Their actions can create momentum in the market, leading to price movements.

6. Economic Factors: Traditional economic factors, such as inflation, currency devaluation, and geopolitical events, can also impact the Bitcoin price como funciona. Investors may turn to Bitcoin as a hedge against economic uncertainty.

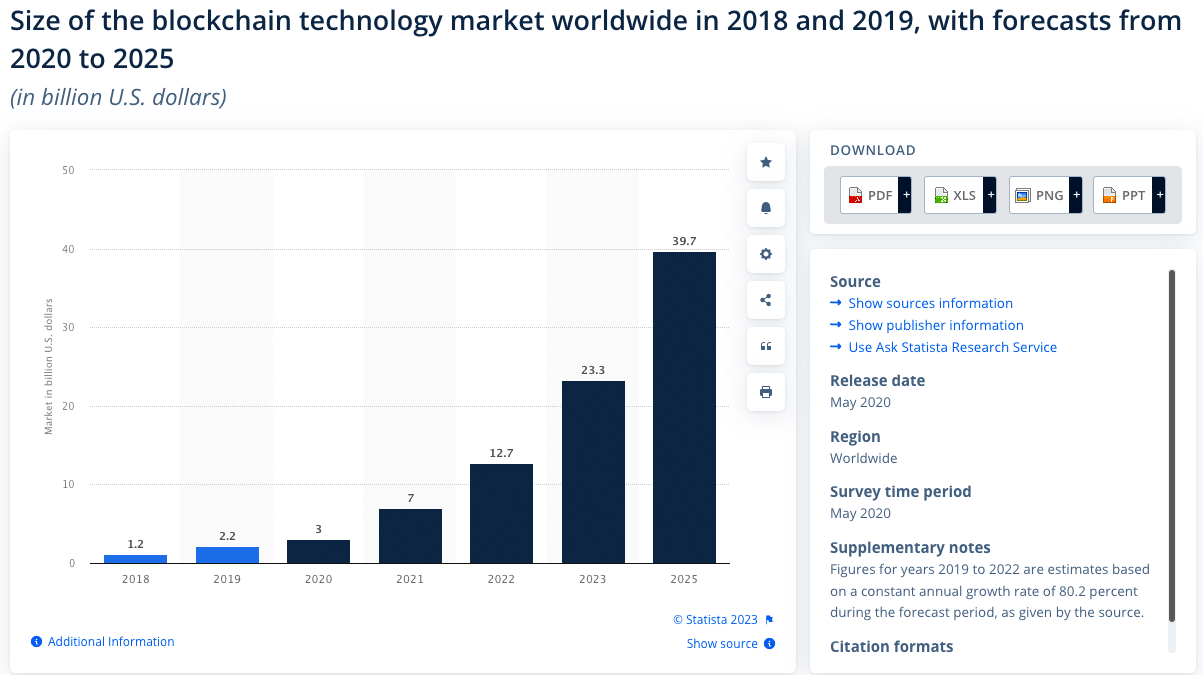

Understanding Bitcoin Price Como Funciona: The Blockchain

The blockchain is the underlying technology that powers Bitcoin and ensures its security. It is a decentralized ledger that records all transactions made with Bitcoin. The blockchain plays a crucial role in the Bitcoin price como funciona in the following ways:

1. Security: The blockchain's decentralized nature makes it nearly impossible to hack, which enhances the trust in Bitcoin and its price.

2. Transparency: All transactions are recorded on the blockchain, ensuring transparency and accountability. This transparency can influence the Bitcoin price como funciona by reducing the likelihood of fraudulent activities.

3. Consensus Mechanism: The blockchain uses a consensus mechanism, such as Proof of Work (PoW) or Proof of Stake (PoS), to validate transactions. This mechanism ensures that the Bitcoin network remains secure and stable, which can impact the price.

Conclusion

Understanding the Bitcoin price como funciona is essential for anyone interested in investing in this cryptocurrency. By considering the factors that influence the price, such as supply and demand, market sentiment, and the blockchain's role, investors can make more informed decisions. However, it is important to remember that Bitcoin is a highly speculative asset, and its price can be unpredictable. As with any investment, it is crucial to conduct thorough research and consider your risk tolerance before investing in Bitcoin.

This article address:https://www.aichavitalis.com/eth/44e11399842.html

Like!(6)

Related Posts

- Can I Buy Bitcoin with a Cashiers Check?

- Why Do Bitcoin Prices Go Up?

- Can't Log In Binance? Here's How to Troubleshoot and Fix the Issue

- Bitcoin Cash to Google Play: A New Era of Digital Transactions

- What is Bitcoin Cash App?

- Can You Earn Crypto on Binance?

- Bitcoin Price List in India: A Comprehensive Guide to Cryptocurrency Values

- Bitcoin Cash to Google Play: A New Era of Digital Transactions

- Binance App Identity Verification: Ensuring Security and Compliance

- Bitcoin Pond Mining App: A Game-Changing Tool for Cryptocurrency Enthusiasts

Popular

Recent

Bitcoin Opening Price Ripple: A Comprehensive Analysis

Subway Bitcoin Price: A New Trend in Cryptocurrency Adoption

Yuan Crypto Binance: The Future of Digital Currency Trading

Title: Register for Bitcoin Wallet: A Step-by-Step Guide to Secure Cryptocurrency Management

015 Bitcoin to Cash: The Intersection of Digital Currency and Traditional Transactions

**The Thriving Market of Binance Coin Trading

What is My Wallet Address on Binance: A Comprehensive Guide

What Was the Highest Price Bitcoin Reached?

links

- Making a Living Off Bitcoin Mining: A Lucrative Opportunity in the Digital Age

- Bitcoin Price Drop Why: Understanding the Factors Behind the Decline

- How Does Mining Bitcoins Work Reddit: A Comprehensive Guide

- ### Decentralized Exchange on Binance Smart Chain: Revolutionizing the Crypto Trading Landscape

- Bitcoin Mining Generator 2.0: A Game-Changer in Cryptocurrency Mining

- Bitcoin Price Export: The Impact on Global Markets

- Why Bitcoin Cash Going Up: The Underlying Factors Behind the Surge

- Bitcoin Cash Bithumb: A Comprehensive Look at the Cryptocurrency and its Exchange

- ### Solo Mine Bitcoin with QT Wallet: A Comprehensive Guide

- Bitcoin Cash Transaction Format: A Comprehensive Guide